How Georgia’s Film and Television Tax Incentives Work

Georgia production incentives provide up to 30% of your Georgia production expenditures in transferable tax credits.

The program is available for qualifying projects, including feature films, television series, commercials, music videos, animation and game development. With one of the industry’s most competitive production incentive programs, the Georgia Film, Music & Digital Entertainment Office can help you dramatically cut production costs without sacrificing quality. So how does all this tax credit stuff work? Our conversation with Ric Reitz will demystify the Georgia film and television tax incentives universe.

The facts about Georgia’s film and television tax incentives.

Naked Unicorn Podcast Transcript

Jason Sirotin:

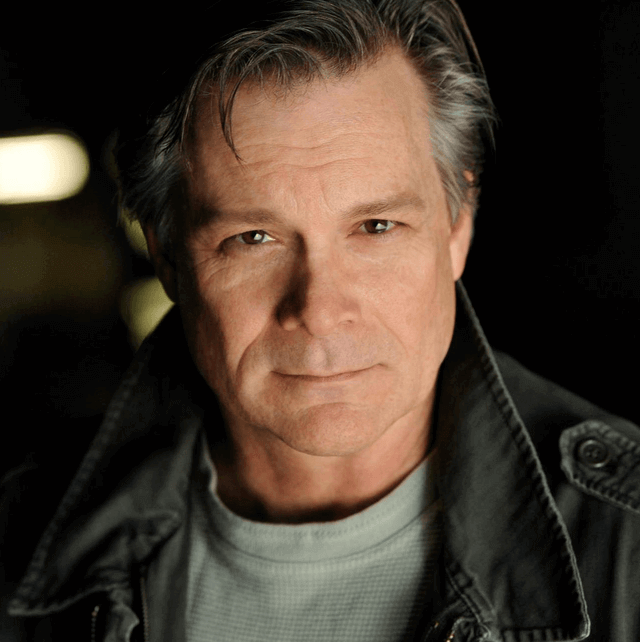

Welcome to the Naked Unicorn podcast. I’m Jason Sirotin. I’m here today with Ric Reitz who is the Co-founder, is that correct?

Ric Reitz:

Partner, Co-founder.

Jason Sirotin:

Partner, Co-founder of Georgia Entertainment Credits. I’m here with Scott Patterson from his Patterson Law Firm. Today, we’re going to be talking about something I get asked about probably 20 times a month. That’s tax credits for film, television and I guess gaming in the state of Georgia.

Ric Reitz:

Interactive gaming, even music videos.

Jason Sirotin:

No kidding. I didn’t know about music videos.

Ric Reitz:

Yes, so there are four likes to this table.

Jason Sirotin:

That’s amazing. I think the very first thing is that a lot of people don’t know but you’ve been in at the heart of … It’s HB 1100, correct? The tax law?

Ric Reitz:

That was the latest one. That was from 2008. There was one previously, I’m not kidding. Every year that you put legislation in, it’s assigned a different number. These bills happen to come out of the House. The HB, House Bill 1100 would be appropriate for 2008.

I actually began in the process in 2003 and ’04. Very few people realized that we first attempted to get tax credits in the state in 2004 and lost. We lost at the legislative level. Then, we came back in 2005, got a modified package in. Then, reorganized in 2008, went with the version that is currently on the table and that would be HB 1100.

Jason Sirotin:

Now, tell me about … If I’m going to make a film or a TV show or a video game or a music video in Georgia and I want to be eligible for these tax credits, what do I need to do? Where do I start?

Ric Reitz:

First thing you have to do is as you position your projects, you need to come up with a minimum threshold of $500,000 per annum or fiscal year depending on what your structure is for your company. That can be in single or aggregate productions.

If you were to make low budget independent feature, expect a legitimately $500,000 in the state, you would qualify for the tax credits which could give you up to 30% back on your official Georgia spend.

If you have a series of commercials, for instance, that you’re putting together and you did 10 $50,000 commercials, those put together in aggregate would accomplish the $500,000 threshold. Therefore, they would be all eligible.

Jason Sirotin:

That’s for the people who are paying it, right? Only the people who put the cash up are eligible for those credits, correct?

Ric Reitz:

Yes. Originally, the statute was for production companies or producers. That became a little convoluted because who in fact is the producer? In a commercial sense, if I’m Proctor & Gamble, I end up hiring an ad agency that hires a production company to do my product. Who gets the credit out of that line of three?

If you interpret the statue to the letter of the original statute, it would have gone to the production company because the production company would have ended up getting the workman’s comp, putting together the insurance packages, taking the highest risk even though they may not have cut the original check but they did the due diligence.

That got modified in 2013. Here we are in the middle of 2014 nearly 3rd quarter, and that law was revised to be the executive producer or company which cuts the check. In this case, Proctor & Gamble would have been the company to get the credits whereas years ago, it would have been you. Does that makes sense?

Jason Sirotin:

Wow, yeah. I lost out.

Ric Reitz:

Well, if you did and you didn’t, here’s what I always tell people. If you’re a production company, they’re coming to Georgia. They’re using you for particular reason. It’s because they must do the production here. You have the local knowledge. You got the staff, the crew and the expertise, the creative. They need you. You are still responsible for probably paying out payroll for cast and crew. Correct?

Jason Sirotin:

Correct. Yeah.

Ric Reitz:

Now, this comes to Scott. In a privacy situation, with you collecting that information which is what the DOR eventually wants, should you be allowed to hand over that information to the executive producer who might be in Cincinnati, Ohio using the Proctor & Gamble example? You go, “Wait a second, I got Social Security Numbers and personal information of all these people. Privacy states I can’t give this to you.” Yet, for you to collect it, you must have this. Deal has to be struck. Now, you’re in the position, still local producer, they go, “Cards are still on my table, let’s make a deal.”

Jason Sirotin:

I could negotiate a portion of those tax credits?

Ric Reitz:

Absolutely so. While they may be aligned to Proctor & Gamble in this example, you may say, for commercials it’s 20% by the way. There’s 20% lower threshold for tax credits for all productions that cannot use or embed a Georgia logo. Obviously, I’m not going to put a Georgia branded logo in somebody else’s branded commercial.

Jason Sirotin:

Right.

Ric Reitz:

Coca-Cola and Home Depot are not going to like that, to get the credits. They get a base 20% just for breathing and being alive if the production was shot here. You get the extra 10% uplifted, 30% if you embed a logo.

Jason Sirotin:

Right, which won’t happen in a commercial. I could say, the Proctor & Gamble, I could say, “Look, you got to get something out of these tax credits. I’d like to get a little something. You’ll take 15%, I’ll take 5% and I’ll get away over this as I can pass along this personal information to you.” Would that cover me, Scott?

Scott Patterson:

Yeah. You’re going to have to watch for the waiver and how broad it is and if you’re getting waivers from everyone that gave you information which is really the way to cover yourself would be, it’d have to be on a case by case individual and individual basis.

Jason Sirotin:

That’s how I would do it.

Scott Patterson:

Yeah.

Ric Reitz:

It’s not uncommon now to negotiate. It’s like a 50-50 split or if you say, 75-25 split of the proceeds or you may say, if you’re responding to an RFP to get the job originally, you may goose your totals and pad you producer fees or production fees to compensate and then the money flows directly to Proctor & Gamble but you were compensated in kind in another way.

Jason Sirotin:

Got you. What I think people forget is like it’s so … I don’t know if empirical is the word but the idea of getting these tax credits, people are just like, “Oh, I’ll just get tax credits.” What do you have to do to get approved to get them? Do you have to fill up some paperwork? Is there a website you go to? How do you get started to get an approved production?

Ric Reitz:

First of all, you’ve got to do a little bit of homework. Obviously, there were originally 44 states that have competitive tax credit programs. That’s now down to 39. Several states have discontinued their programs including Florida, which took itself off the map. North Carolina has just reconfigured itself. It has only a 10 million dollar annual grant. They’re pretty much out of the game.

Scott Patterson:

That’s nothing.

Ric Reitz:

That’s nothing. They were giving away. They were subsidizing or participating and incentivizing up to about 140 million a year. They’re down to 10. They’re pretty much out of the game. I hate to say that because I have lots of friends in North Carolina and they’ve got a lot of thinking to do now about where they need to work. We need crews. We need talent and by all means, come to Georgia. Same thing with the people in Florid, we have a shortage now of talent from all perspectives. Come to Georgia. We need you. We can’t fulfill the orders.

Jason Sirotin:

When I’ve got a production … let’s use, since we’ve used Proctor & Gamble, right? You know what, Kimberly-Clark is one of my biggest clients. Let’s use Kimberly-Clark.

Ric Reitz:

Perfect.

Jason Sirotin:

If I’m doing a project with Kimberly-Clark and it’s going to be over 500,000 or I know this year, they’re going to spend over 500,000, what is the first thing I need to do?

Ric Reitz:

That will be for commercials, right, as opposed to corporate? Corporate’s not included in …

Jason Sirotin:

Commercials. Let’s say they’re television commercials.

Ric Reitz:

All right. You’re going to do these television commercials. Since you’re going to be doing numbers of them in aggregate, it gets a little bit more complex.

Scott Patterson:

Let’s just do one to make it simple.

Ric Reitz:

All right. One commercial, 500,000 plus.

Scott Patterson:

Correct.

Ric Reitz:

Call $550,000.

Scott Patterson:

Correct, got you.

Ric Reitz:

Just because your budget is 550 doesn’t mean you would qualify all 550,000 or 500 by the way. I always recommend to people, goose it a little bit in a budget. You’re in a budget. You’re doing a low budget indie. I would always say try to target $600,000 between 500 and 600 because 10% of that budget may or may not come back to you in the form of tax credit. You don’t want to be slightly below the threshold. Anyway, what’s your point?

Jason Sirotin:

Okay, but I do want to hit on that later. I want to know like why wouldn’t all the money be …

Ric Reitz:

Sure. That’s easy.

Jason Sirotin:

Okay.

Ric Reitz:

Anyway, you want to get started. You know you’re going to have a production. Let’s just arbitrarily call it $550,000. You know you’re going to target it plus or minus. We’re going to squeal it in. It will be 500 plus. Now, you have to go to the Department of Economic Development Film office, we just call it the film office but it’s part of that division, sub-division of the government.

They have a three-page form that you fill out. You qualify the project, prequalify the project by showing them a top sheet budget which is of course been derived from the whole budget but you can show them the top sheet, a script or scripts, the intention of distribution. If it’s a commercial, it’s going to be nationally broadcast. Is it on cable television? It has to be transmitted outside of the state of Georgia.

The reason they created that scenario is because they didn’t want to incentivize work that was already present here like car commercials where you make a thousand car commercials a year, standing on your lot, and you’re only showing it in Atlanta, Georgia. We don’t want to incentivize those people. We want to send our message out around the world. Now, you know you’ve got a distribution plan for this commercial. It’s going to go somewhere outside of the state of Georgia.

Jason Sirotin:

Right.

Ric Reitz:

You fill out this three-page form. It won’t take you 30 minutes. It won’t. You’ll be digging up your information to fill in some slots but if you have your information, it will take five minutes literally. Generally, you want to do that for films and other broader projects within 90 days of principal photography. They generally don’t like to entertain and seeing this paperwork. If you’re hefty or out, some people will try to pre-certify a project in hopes of getting it funded for instance. The certification really comes after you funded.

Jason Sirotin:

What if you’re in a situation where it’s a go-go-go, we’ve got to hurry up, is that going to be bad?

Ric Reitz:

They can turn the paperwork around in two days tops.

Jason Sirotin:

Okay.

Ric Reitz:

What they do is they give you a certification number, doesn’t mean your project is fully certified. It is a pre-certification number. They will issue a letter. It gets a stamp. They sign it. You sign it, and now, you’re given a number for the project. It really becomes a tracking number. It’s like you would do anything in the [crosstalk 00:11:21]

Jason Sirotin:

It’s like a Social Security Number.

Ric Reitz:

Yeah. I’m going to track it. This is job 66273. It’s a stock assigned to your company at ECG.

Jason Sirotin:

Got you.

Ric Reitz:

You go, “There it is, ECG, this is 2014 and blah, blah, blah and here’s the number. Go ye and be great. I hope you do everything you say you’re going to do.” Now, you go and you do that. You end up doing the project. You end up doing your accounting and keeping that independent of the other projects so it’s easier to follow. At the end of the project, you’re going to have it … What’s the best phrase …

Jason Sirotin:

Audited?

Ric Reitz:

It’s audited. There are two choices. There’s an audit and a review process. What the government prefers, to be honest with you, this was derived from buyers, what buyers have tax credits prefer is that an independent set a third party eyes, look at the paperwork because they’ve heard all the horror stories about entertainment accounting.

If your imagination is fabulous as your work, they want to be certain that it’s real on the paper. You have two choices. You go with the third party CPA that does that work in the state of Georgia, there any number of them that I could recommend and you could certainly get from the state. They will do us a review or you have a choice of going to the state and asking for a full audit. Why would you do one versus the other?

Jason Sirotin:

Great question.

Ric Reitz:

Yeah. I’ll ask the question to myself. Don’t you think? It depends on what your timestamp is and when you need the money back. An independent CPA will generally turn around the paperwork a lot more quickly than the state auditor. Here’s the reason. There’s one state auditor. He lives in California. He has a backlog of projects in small independents to full studio productions and he’s trying to cover it in a year. He’s got a couple of assistants and some staff but you’ll probably be backlogged six months or more. You complete your project. You’re hot to get your money. I need the audit.

Jason Sirotin:

Now, when you say complete the project, done and out for distribution?

Ric Reitz:

Done and out the door or what at least to the point of your bookkeeping where you are no longer trying to qualify expenses.

Jason Sirotin:

Got you. You spent your money.

Ric Reitz:

You spent you money to the extent that you’re going to get the tax credit. At the end of that processes, now, you want to close your books, you want to have a third party review, once … Now, let’s just distinguish between the state audit and an independent CPA. Why would there even be a choice one to the other?

Jason Sirotin:

One is free and one’s not, right?

Ric Reitz:

No, they both cost approximately the same.

Jason Sirotin:

Really?

Ric Reitz:

Right. The independent CPA will generally turn your work in 60 to 90 days. The state will take six months or longer. Now, for the big boys, Warner Brothers and Sony and Disney, they’ve got time. Money is not the issue to them. Time is not the issue. They just want it back, eventually. An independent doesn’t get the opportunity to free will without the cashback from investors or the company or what have you. You want your discount now.

You say, “Well, this is a no-brainer. I want the CPA. If they’re going to cost the same and one is faster, why wouldn’t I use the CPA?” There’s one reason. The state still requires in the statute that it has a three-year look back provision. Anytime you would file state or federal taxes personally, forget corporately, personally, the state and the feds always reserves the right to audit your books either randomly or not within three years. If they missed the three-year window, that book is closed.

The state wants to hold that three-year window open. With an audit from the state, the book is closed instantly. You may have waited three more months but …

Jason Sirotin:

It’s a guarantee you don’t have to give the money back.

Ric Reitz:

The money will never be given back. Whereas an independent CPA, will get you 98, 99% all the way there because their due diligence is fantastic but they can’t guarantee …

Jason Sirotin:

It’s a safe bet.

Ric Reitz:

It’s a safe bet. Now, that reflects itself back in the price of your tax credit and it also gives a higher assurance to the buyer in going, “What happens if I paid you the money and they take this back?”

Jason Sirotin:

Let’s be clear. When we’re talking about a higher payment for your tax credit, you’re talking about when you or your company or company like yours takes those tax credits, you can get either 89 cents on the dollar or you might get 69 cents on the dollar, right?

Ric Reitz:

That doesn’t … Fluctuation isn’t that broad but the difference could be 85, 86 cents on the dollar versus 89, 90 cents on the dollar. Every dollar counts particularly for the little guys. The reason that we asked the state to allow, and it’s an optional always of the producer to allow the state audit, is the little guys were getting punked because Warner Brothers would come in and go, “I had a CPA audit.” ECG comes in, says, “I had a CPA audit.” You go, “Why won’t I buy the ECG credits?” It’s because the buyer without a state audit needs an indemnification and a guarantee that if anything goes wrong, you’re paying because they had no resource to the books.

They’re trusting me. They’re trusting you to deliver credits that are free and clear. If something goes wrong, they didn’t do anything. You potentially did something wrong or it was people making clerical errors, it happens, and they rectify it. What happens if the state comes back to reclaim? I’ve already paid tax credits or bought them from you and they reclaim a portion or all of that tax credit? I not only have to pay back what’s missing but penalties and interests.

Now, you start to see why a buyer gets nervous. In the marketplace, I will get a smaller benefit by going to an audit. Then, I will, a greater benefit by going to an independent CPA. The level of field for the little guy because now, you’ve offered an indemnification and a guarantee just like Warner Brothers, now it comes down to credit worthiness. If something goes wrong, who’s going to stand behind it?

Jason Sirotin:

Right. ECG or Warner Brothers.

Ric Reitz:

Warner Brothers which is publicly traded, Time Warner to New York City stock exchange.

Jason Sirotin:

Right. It’s a pretty safe one.

Ric Reitz:

Well, right but I’m telling you, the buyers in this market now that we’re into our sixth year of tax credits in earnest had become more sophisticated that they are demanding that level of protection out of everything. We had to ask the state to protect the little guy, to allow the audits so that you have the same access. Now, two companies with an audit, you’re equal to Warner Brothers now. You waited six more months or three more months or whatever it was but now you are on a level playing field, ECG and I’ll sell at 89, 90 cents not 85, 86.

Jason Sirotin:

Now, is the indemnification still coming in to play then if you go with the state audit and you’ve got that no more look back? Do our sellers still have to give indemnities?

Ric Reitz:

They still want to see some sort of language that indemnifies and guarantees because they want protection against fraud which has no statute of limitations for this scenario and you kind of go, “Oh. I can still work it.” I can tell you right now because I’ve had a lot of experience doing it. Indemnifications and guarantees for small companies that have the audit are no less valuable in the marketplace. I’ve had no issue with that. People love to see the audit. We even call it the golden ticket. It’s an unofficial phrase but if you got the golden ticket from the DOR, if you do, I’ll buy those.

I don’t care if I’ve never sees these guys. I don’t care if it’s for Kimberly-Clark or Rooms To Go or whoever it happens to be. I have a client that does all the Rooms To Go client productions and commercials in the state. They’re from Florida. They come up and do all the commercials in Georgia and then they go home.

It works. We want to work with small and independents so we did that caveat. We also tried to help with a provision for buyers in the original statute. It actually wasn’t mentioned in the original statute but it came into play because the DOR was overloaded with work. There was a point in time for the first three or four years were people who owed 100,000 or more in taxes to the state of Georgia were the only ones eligible to buy the taxes.

To owe a $100,000 plus in the state of Georgia, you have to have a net taxable annual income of $1.8 million or more. How many people do you think there are in state of Georgia? There are a lot but there aren’t enough.

Jason Sirotin:

Right.

Ric Reitz:

There are more people under that threshold than there are above. It took me three years of lobbying to get the DOR to say anybody who has his Georgia state income tax liability made by these tax credits. Some companies, Disney for instances, still doesn’t like people for under a $100,000. Warner preferred that for a while but I talked them out of it.

Jason Sirotin:

Disney will go and search for people to buy tax credits from them?

Ric Reitz:

They will search. There’s still higher local brokers but they pay an administrative fee to the broker for every contract. Well, I want fewer contracts.

Jason Sirotin:

Here’s the thing though. Why would ABC need to sell tax credits? Don’t they have a big enough tax liability or is it because it’s not, the tax credits are only good in Georgia?

Ric Reitz:

They’re only good in Georgia. It’s a state tax credit liability versus federal.

Jason Sirotin:

Now, is that why it’s working so well here because we have so many corporations here that are located here?

Ric Reitz:

Well, corporations, it would seem to follow that Fortune 100 and 500s would be the prime targets to buy these tax credits. Historically, they have not.

Jason Sirotin:

Why?

Ric Reitz:

Well, a long story short, the big four accounting firms, you get the Arthur Andersen’s and you get all the big names that you can think of, they don’t have, to date, not been recommending the tax credits to their largest clients. No matter how many times I’ve walked through the door or others have walked through the door to encourage them going, “You’ve got stockholders. You’ve got this and that, for gosh sake, save a million bucks.” They go, “Well, I don’t know.”

Jason Sirotin:

They still feel like it’s too risky?

Ric Reitz:

They feel like it’s too risky to them. That was their thinking prior to the audit situation.

Jason Sirotin:

Got you. Now, it’s getting better.

Ric Reitz:

It started with Georgia Power for instance was the first corporation to buy them. Now, Walmart buys them. Apple buys them in Georgia. We’re trying to get Rubbermaid and UPS and Home Depot and Coca-Cola.

Jason Sirotin:

GE.

Ric Reitz:

None of whom currently buy credits.

Jason Sirotin:

That’s crazy to me. Let’s go back to the audit real quick. What do you submit? What does the producer submit? Let’s look at it from, I got paid to do this commercial for Kimberly-Clark and now, I am submitting what for the audit?

Ric Reitz:

In the smaller sense, not a lot of all the small companies tend to engage a third party firm to put together their bookkeeping like ADP or Entertainment Partners, cast and crew, the traditional people that you might hire to run payroll. Those people will have a complete payroll payout list that is computer generated. That has to be available to be turned over. It’s not turned in unless requested but it must be made available. Then, they’ll sign off on it saying this is all legitimate and correct.

Jason Sirotin:

How do they check it? Do they check it … Do they have to give them receipts or you’re just giving them …

Ric Reitz:

Every time somebody does a thing out on a payroll, for instance, when they’re doing time cards and that sort of thing and signing out every week, a vendor will turn in a receipt. The receipts have better be real and they’ll be double checking and back-checking. You would come to the audit with your receipts, drawers full if that’s what it takes, petty cash, whatever else that you’ve done and recorded. You got to have that available.

Jason Sirotin:

Got you. It’s about meticulous bookkeeping.

Ric Reitz:

It really is. Other states will try to do a bookkeeping review while the production is just wrapping up because everybody is there. If you’re visiting from out of state, you’ve got your team on location, why not do the review here and now?

Jason Sirotin:

Now, I’m approved. I did my bookkeeping right. The DOR or the third party or whatever has said, “All right, we’re good.” I call Georgia Entertainment Credits and I get on the phone with you, Ric. What happens then?

Ric Reitz:

I’m going to ask for your due diligence. I’m going to ask for the certificate, the pre-certificate that you got from the film office. I’m going to ask for your one of two things. I’m going to ask for a comfort letter from the third party CPA which shows their review process, a letter that they signed and put their reputation to.

Jason Sirotin:

Is that if I use the third party?

Ric Reitz:

That’s correct. Now, if I use the state, the state will have an audit verification letter which is generally a one-page letter but it also has its own stamp and number and approval. I have to have one or the other. Then, you come to me and you say, “I would like you to represent my credits into the marketplace.”

Let me say it this first, for companies that are not based in the state of Georgia, they’re clearly going to go to the marketplace and sell their credits. For people who are based here, you actually have payroll. You possibly pay state income tax for the corporation using ECG again as the example.

You can, without going to the third party market, you earn 30% or 20%. You’re doing commercials. You got 20% on $550,000 there. You’re going to have $110,000 in tax credits coming your way. Okay?

Jason Sirotin:

I’ll take it.

Ric Reitz:

Based on 20% of the 550.

Jason Sirotin:

Right.

Ric Reitz:

You’re going to have a 110K in tax credits that are going to come and you’ll go, “Well, if I sell that …” Remember, I get 30% as a gross tax credit. That doesn’t mean you’re going to get all 30%, all 110,000. That’s how much you earned but now you have to capitalize it. The thing is, if your production company that’s localized here and you owe state income tax, you can take that portion that you owe out of $110,000 at the full 30% and use that for your tax liability.

Jason Sirotin:

Then, I’m getting the full 30.

Ric Reitz:

Then, you’re getting the full 30. Then, whatever is left over, if there’s something left over, then, you can sell that into the third party market.

Jason Sirotin:

Do I need you for that or is that something that our internal accountants would be able to do?

Ric Reitz:

If you have the relationships and you know people who would be interested in buying the tax credits, you certainly are capable of doing it.

Jason Sirotin:

I’m talking about for if I was to absorb the 110,000.

Ric Reitz:

If you’re going to absorb the $110,000, you have to let the state know, you have to let the DOR know, I believe it’s a 60-day notice in advance of your claiming those credits, that you’re going to use those a $110,000 in credits.

Let’s say you’re talking about your 2013 liability but you only owe $80,000 in 2013 and I’ve got an extra $30,000 leftover now. You go, “Can I carry that forward?” Yes. Tax credits carry forward after the year of origination for five more years. Tax credits, for instance, here we are in 2014 and we timestamp everything based on the year of production or fiscal year. You did your Kimberly-Clark thing in 2014. Those credits are good for 2014 tax credits, ’15, ’16, ’17, ’18 and ’19. That’s a full six years of being able to use them. Not a lot of people want to carry forward that far.

Jason Sirotin:

How come?

Ric Reitz:

Because of cash flow. It becomes about, “Do I want to hold that out and just …”

Jason Sirotin:

Can I grow that into more money or do I just want to sit, let the government grow it?

Ric Reitz:

That’s right. It becomes your strategy.

Jason Sirotin:

I need to sell the tax credits, right? I come to you and I say, “I don’t have that bigger tax liability. Ric, help me sell them.” What do you do? What is your approach?

Ric Reitz:

My approach is this. I’ll sign an agreement with you that I’m allowed to exclusively represent them for a period of time and if I’m not able to sell them and do the performance aspect, they would obviously come back and you could sell them through other people. Trust me, I don’t have an issue. I always sell them.

You come to me with the $110,000. I will ask for that letter of comfort. I will ask for the audit letter if that is the other option. I will ask for the certification and within the comfort letter and certification, there has to be another document that the production company must render to the Department of Revenue. It’s called IT-FC. That form is a registration of what you are claiming as the tax credits. That could suffix to your income tax filing for ECG for the year 2014.

When you file those taxes, that form must be included. Why is that important? This becomes the first official registration of what you earned, what you kept or didn’t keep and what volume you’re going to sell. That goes to the DOR.

Here’s the red flag. I’ve got tax credits. Here they are. This is the homework. I’ve got the paperwork to back it up but here’s your registration. Why is that important? It would be reconciled later. Once I’ve sold your tax credits, I will issue to every buyer what is called an IT-TRANS, transfer, intellectual properties transfer. That will reconcile against the IT-FC at the end of the day whether I sell it to one person or a hundred persons, they will all have that and their numbers had better add up and match the IT-FC perfectly to the penny.

Jason Sirotin:

For people who are going around town going, “Tax credits, tax credits,” most people don’t know what the hell they’re talking about.

Ric Reitz:

That’s correct. We’ve seen a lot of … It’s the Wild West. We’re getting a lot of people. It’s an unregulated territory. Scott, you’ll understand this more than ever, is the kind of pressure that it puts on people. People who think they’re doing it right can actually disqualify you by doing it wrong. Once disqualified, you’re out. There’s no getting that back.

Jason Sirotin:

Right off the top of your head, what are some top five disqualifications?

Ric Reitz:

Not including the appropriate IT-FC with the calculations, they don’t reconcile, not issuing the IT-TRANS within a specified period of time. At the conclusion of every sale, your $110,000 in tax credits, let’s say I had five people buying those credits in total. There will be five IT-TRANS. I have up to 30 days from that sale date and there’ll be a sale and transfer contract.

There’s a contract that you would have to sign that my company would generate sale and transfer contracts, Scott’s fully aware of what we’re talking about here, that says, “Here’s our deal.” It’s not a handshake. There’s a real contract. “Here’s the real due diligence. Here’s your IT-TRANS.” The IT-TRANS is in fact your voucher for the tax credit and you buy a tax credit at a discount.

If I were to buy $110,000 in tax credits at … I don’t have a calculator. Let’s make it easier. Let’s do $100,000 and I bought them at 89 cents. I would pay $89,000 for a $100,000 worth of tax credits.

Jason Sirotin:

The person is saving $11,000.

Ric Reitz:

$11,000. Now, they will pay 89,000 but they will be issued a $100,000 IT-TRANS that is verified through the brokerage. Here it is. Here’s the exchange. This is the legal tender now.

Jason Sirotin:

It’s as good as cash.

Ric Reitz:

It’s as good as cash and it’s recognized by the state because it’s on the state form.

Jason Sirotin:

Is this just for state taxes, not federal?

Ric Reitz:

Just for Georgia state income tax, not Kentucky. I don’t know, nobody who’s close, it is just here. You don’t have to be a resident. You just have to owe taxes here to be able to qualify to buy these things. Another way that you can disqualify yourself is, I have 30 days to register that IT-TRANS with the DOR and Economic Development on your behalf. If I don’t do that in time, they’re disqualified. You wouldn’t believe how many people missed the deadline because I didn’t know.

Now, I sent in an IT-TRANS to the two main bodies for the government. The taxpayer that bought the tax credit also puts in an IT-TRANS on their actual tax form. Now, there are three resources of this IT-TRANS, same trans. it all has to match the IT-FC.

Jason Sirotin:

What was your question, Scott?

Scott Patterson:

The money that comes back to ECG for having sold those credits, how is that treated for tax purposes? Because obviously, there was a tax credit to them so they would’ve paid. Obviously, it wouldn’t have been an income to them. Now that there’s a sale, as it come back, how is it reflected back on ECG’s books?

Ric Reitz:

On ECG’s books, that becomes a reimbursement of costs. It’s not revenue so it is not a taxable event for you. You’re getting cash back you spent, $550,000 in the budget, you just reconcile your books and you go, “I just accounted for $110,000 worth.” 89,000, you won’t get 89,000, that’s the discount to the buyer. There’ll be legal administrator from broker fees. You will probably net 86 to 87 cents. You’ll make, I would say arguably $87,000 on 110.

Scott Patterson:

Let’s talk fees real quick. You’re telling me, there’s an administrator fee by who? Is that you?

Ric Reitz:

By me.

Scott Patterson:

Okay, what is that? 3%? 5%?

Ric Reitz:

No. As a matter of fact, I stay competitive. No more than three. If you’re paying more than three in this marketplace, you’re paying too much.

Scott Patterson:

See, that seems, just because I’m seeing how complex it is and how bad it can get messed up, that seems so cheap to me.

Ric Reitz:

It’s an element of scale. The larger the account, one or 2% of $5 million is a lot of money. One to 2% of $50,000 is not so much.

Scott Patterson:

But you still do it?

Ric Reitz:

I still do it. The reason is the business is new. I invested in the business because I helped create it. I was on the team of people that created this tax incentive scenario in Georgia to begin with. I want it to work. I wanted everybody to be able to buy tax credits. I wanted everybody to have the chance to earn the tax credits whether they were state bound or not.

For me, I’ll do whatever I can to make sure that there’s a deal. I will tell you typically, the spread and in that spread, my business partner is an attorney. I don’t know if you know Wilbur Fitzgerald at all. You may know him. He’s an actor but he’s also an attorney.

Scott Patterson:

Yeah, I know him. I don’t know he was an attorney.

Ric Reitz:

He is. He plays one on TV.

Scott Patterson:

I know. That’s true.

Ric Reitz:

But I’m not a CPA, neither is he but we’re really good at our due diligence because we developed the bible so we know how to do it. We even asked the state to certify all the brokers and they won’t do it.

Jason Sirotin:

Did you have this plan early on, Ric? When you were doing the plan, were you like, “I’m going to build this plan and then be a broker?”

Ric Reitz:

No. Absolutely not.

Jason Sirotin:

Because if so, you’re an evil genius.

Ric Reitz:

No.

Jason Sirotin:

Or a very helpful genius.

Ric Reitz:

You want to know something? People have accused me of that and even at the highest levels of the state, it is absolutely incorrect.

Jason Sirotin:

Who cares? You’re doing it right.

Ric Reitz:

When I was working for free, nobody cared. As soon I started making money, everybody cared because they thought that I’d created the whole scenario along with Wilbur so that we could make money. It was no, we want to work at home because we were working out of state.

Jason Sirotin:

How much did Georgia make last year?

Ric Reitz:

Georgia did $1.4 billion of direct investment. $1.4 billion. Before the tax plan, it was $65 million a year. Now, we’re $1.4 billion a year. That set aside, here’s the scenario. Stop and think about this because I don’t want the people to get the wrong impression about what we did.

We started in 1995 at the Georgia Production Partnership then called the Atlanta Production Partnership before we expanded it and incorporated 1998, all volunteer organization. I sat on its board for 16 years, was its president. I was in-charge of the committee and the chair of the committee that did the tax incentives. I wrote the business plan for the state of Georgia along with Wilbur. I did the national research because there wasn’t research.

The governor said we need a business plan and I need to focus on what is the marketplace, how much business is out there? How much do we have? How much do you think we can grow a real business plan? Wilbur and I sat and scratched our head and we go, “We’ve never written a business plan like this before. What are we going to do?”

Jason Sirotin:

Right. It’s complex.

Ric Reitz:

We did the work. We missed out on a lot of Christmas vacations and New Year’s vacations and worked our way through it, called every state, every newspaper that had statistics only to find out that nobody kept statistics. They were apples to oranges everywhere you went. We had to come up with logarithm that took everybody’s information and tried to center it so we could compare apples to apples. That was hard. Then, we wrote the business plan after that.

Jason Sirotin:

How dare you want to make money?

Ric Reitz:

I know. We did that and then my company, you know I have a production company as well, my company designed the three dimensional logo. We took it from the flat 2D, somewhat colorless aspect and drew it out because we knew we wanted the logo on screen as a branding aspect to our program.

Hollywood laughed at us and said, “You’ll never come up with a logo that compares with Steven Spielberg and the major studios. We’ll be embarrassed to put up your logo,” so like you, we cut a logo that is first grade. Then, I donated it to the state. My company made it. We donated it. I paid the money out of pocket.

Jason Sirotin:

How dare you.

Ric Reitz:

How dare I do that and I’m still doing it for free.

Jason Sirotin:

All this work for free.

Ric Reitz:

Over 16 years.

Scott Patterson:

It was obviously your long play [crosstalk 00:38:13].

Jason Sirotin:

This is all really well thought out.

Ric Reitz:

I’m an evil genius from that.

Jason Sirotin:

16 years long played.

Scott Patterson:

It’s a long time.

Ric Reitz:

But the first year, it’s curious because it really didn’t happen in earnest until the year 2008. In 2009, when it all started to happen, nobody knew what to make of this. Everybody called me from around the world and the state would sent people to me to talk to, to go, “How does this work?” because the state didn’t even know. I answered the phone every day for a year for free. How dare I.

Jason Sirotin:

How dare you. It’s disgusting.

Ric Reitz:

Then, one day, I had an epiphany and I went, “What the hell am I doing?” Why don’t I start a consulting company if nothing else? We started as consultants. People, it turned out, never wanted to pay the consulting fee. I had the backend load, the consulting fee and become a broker so I’d get some money but we don’t take anything in advance.

Jason Sirotin:

Because you were taking all these time out of your day, at no cost to do something good for the whole community and then everybody turns into a giant asshole and was like, “Oh Ric, all that free work you did, we don’t want you to ever get paid.”

Ric Reitz:

That’s exactly, that’s how it came down. At some of the levels, I was asked to terminate out of some of the major committees on the state because I suddenly had a conflict of interest. I went, “Everyone in the room has a conflict of interest.” That’s why we call it government. Come on guys. Let’s get real.

Jason Sirotin:

That’s so crazy. Now, when you’re out filling these tax credits, I want to go back just real quick because I want people to understand the fees. It’s 3% to you …

Ric Reitz:

No, as a matter of fact …

Jason Sirotin:

That’s everything?

Ric Reitz:

3% is the max. The thing is that’s inclusive of all fees. That’s the max. I’m generally taking 2% or less now …

Jason Sirotin:

Seems so low.

Ric Reitz:

Because the margins are being squeezed, we went from five brokers in 1986, 10 brokers, five in the state, five from out of state. There are now nearly 50 brokers represented in the state of Georgia. Probably, only 10% of which know what they’re doing but there are 50 brokers.

Jason Sirotin:

How many people have lost money, do you think, going with bad broker’s firms and how do you pick? How do you know who’s legit and who’s not?

Ric Reitz:

You’re going to have to do some background checks. You’re going to have to get references. You’re going to have to look at the long play and how long have they been in business and this and that. I’ve only been in business for five years. I’m actually a neophyte compared to everybody else. There are large institutional brokerage firms not only from the state of Georgia but internationally. They’re now representing the state that I have to compete against studios.

For instance, I don’t represent Disney because Disney said I don’t have enough brick and mortar. I don’t have enough overhead and partners and marble floors and furniture to justify to the board of directors that I’m going to have Ric sell their tax credits. What they don’t know is Ric continues to sell their tax credits via third party because they can’t do it. They hired somebody that has all that stuff and they’re not selling the credits.

Jason Sirotin:

We just need to build you a website that makes it look like you have a brick and mortar and a staff, Photoshop you into some things.

Ric Reitz:

Truthful.

Scott Patterson:

Ric, because people just want that perception. They want to think that who they’re dealing with is so great. I think that’s why so many con artists make it. You’ve got a real guy, Ric Reitz, doing real things at Georgia Entertainment Credits and you’ve got all these other bozos who probably are just like, “Oh, this is an easy way to make money, I know some rich people, I’ll sell some tax credits.” Then, mess it up. They make some quick money and then they leave the state and move on to something else.

Ric Reitz:

They’ll whack you for three to 5%. I can frankly tell you right now with the competition in the market, if you’re paying more than a 2% spread, it’s too much and that has to be inclusive of all legal administration and broker fees.

Jason Sirotin:

Is the documentary a feature film, a commercial, a music video, is that all inclusive in the tax credit?

Ric Reitz:

Meaning?

Jason Sirotin:

If I’m doing a documentary, it’s the same as a feature film, right?

Ric Reitz:

Yes. As long as you make the minimum threshold, you count.

Jason Sirotin:

Right. I would love to know who’s making $500,000 music video.

Ric Reitz:

They’re all in California. They really are.

Jason Sirotin:

Do they come out here to do the videos to get tax credits?

Ric Reitz:

Just like everything else in the video business and the music business, literally, you know that product garage band that you get on your iPod or your iPad or this and that, it’s true. People are doing it in their basement. They’re doing it their garage. They’re doing it on the road. All that stuff doesn’t exist. The whole paradigm has shifted about what production is and who should be doing it. We all get the toys because the toys got cheap.

Remember, when you wanted to get a Panavision camera, it was $250,000 and so you had to rent it because you couldn’t own it. Now, you can go out and get a high-def camera. I know you’re always loading up. What was your last high-def camera?

Jason Sirotin:

We bought the Blackmagic Cinema Production Camera 4K.

Ric Reitz:

For how much?

Jason Sirotin:

Three grand for the body.

Ric Reitz:

There you go. You see what …

Jason Sirotin:

It’s 4K and it’s beautiful.

Ric Reitz:

You’re cutting in on what? Final cut HD?

Jason Sirotin:

Premier.

Ric Reitz:

Premier. Adobe Premier.

Jason Sirotin:

Yup.

Ric Reitz:

You’re working that zone, total investment probably for storage because you got to be broadband storage and all that sort of thing. You can still be in this business for $25,000.

Jason Sirotin:

Yeah. Look, in some productions, even if you go up to a RED, you’re still looking at for a really nice RED package, you can get it for under 60 and have a really amazing package.

Ric Reitz:

Do you want a 2K or 4K even though the people are delivering it …

Jason Sirotin:

or 8K.

Ric Reitz:

… and it keeps going up exponentially. The whole thing is, you can’t even deliver that to the client, they can’t play it. When this become overkill and …

Jason Sirotin:

Yeah, the cost inventory is …

Ric Reitz:

They’re doing Star Wars. They’re shooting it on 4K or 8K? Do you know?

Jason Sirotin:

They’re shooting it on film?

Ric Reitz:

You want to know why? Because last time George Lucas went out and did one, they can see the Velcro and the zippers and the make-up on all the creatures because it’s so high-def, they needed the film to grain it and dumb it down. They’re shooting film. Walking Dead shoots film because there’s something different. It doesn’t look like a soap opera. It looks gritty. There’s still room for some 35 millimeter and people are going to blow it up at 70 millimeter [crosstalk 00:44:32] the big screen. That’s few and far between but the rest of the market is, quite frankly, for $25,000 you can go out and produce a broadcast worthy production.

Jason Sirotin:

Yeah. How long does it take you to sell a tax credit typically?

Ric Reitz:

Depends on the time of the year. This is what people don’t understand like, “Oh, I finished my production, when can I get my cash?” It’s always, that’s my favorite question then. You go, “When you’re shooting your production, when are you getting me to do due diligence?”

They go, “What do you mean?” I said, “Are you in the first quarter? Second quarter? Third quarter? Fourth quarter?” They said, “Why should that make a difference?” Let’s do an illustration. We’re in 2014. You’re going to sell your 2014 tax credits. When do you think people will want to buy 2014 tax credits?

Jason Sirotin:

February. March.

Ric Reitz:

Of 2015.

Jason Sirotin:

Yeah.

Ric Reitz:

When their taxes are due. It’s a real simple …

Jason Sirotin:

Supply and demand.

Ric Reitz:

It is a simple scenario. First quarter of every year, third quarter of every year are the two hotspots. Why? Corporations are due on March 15. Individuals and other things are due on April 15. Extensions go to September 15 and October 15. People are hot in the water because I owe the bill now. I want my credits now. [Inaudible 00:45:47] have 15 messages today going, “Do you have any credits left?” The answer is no.

Jason Sirotin:

You’re out of credits?

Ric Reitz:

I’m out of credits. It’s not even October month. They’re gone.

Jason Sirotin:

Are you active? How do you even book for credits?

Ric Reitz:

We go to production companies like you. We go to Los Angeles and try to deal with the networks and studios. The larger independents, distributors and go, “What do you got coming to Georgia? Let me give you my portfolio. Can I represent you?”

I’ll try to get in early and get them, as a consultant agreement, where there’s no upfront cost. I only get paid if the project happens and you collect the credits.

Jason Sirotin:

Sounds fair.

Ric Reitz:

That’s when I get the credit. Everyone else wants to play the game of [crosstalk 00:46:28].

Jason Sirotin:

Ric, you’re not working for free. If you could do it for free …

Ric Reitz:

I would. People would love me. The state would love.

Jason Sirotin:

Of course, they will.

Ric Reitz:

I could run for governor.

Jason Sirotin:

Scott, do you have any questions? We’ve learned so much today.

Scott Patterson:

I had a question going back to earlier when we were talking about if the payer receives the credits and if ECG has a contract with Kimberly-Clark and Kimberly-Clark’s going to be the payer but ECG wants to take advantage of the credits. How is that handled contractually between Kimberly-Clark and ECG or is it from if they go to Kimberly-Clark, how does that exchange work back and what does the state need to know?

Ric Reitz:

That needs to be worked up before you get to the broker phase, is you work out the deal. Once again, go back to 50-50, 75-25 or you bump your … Knowing that you’re doing all the work and handing them the work that you have to advise all the employees and people that are turning over personal information that you will be giving this information to this third party. That is a way to CYA, cover your ass, serious.

No, because the transfer of private information is a hot button in the world. Take a look at Home Depot and getting ripped off in credit cards and having been pilfered. Create an internal agreement. I would recommend a lawyer, whoever is doing your legal work to strike up a several page agreement going. I’m going to do the due diligence. You’re going to collect the credit because you’re in line to do it. We will do this as a split once proceeds are generated.

Jason Sirotin:

Would Kimberly-Clark pay us?

Ric Reitz:

Yes.

Jason Sirotin:

They would get the tax credits and then pay us now because it’s coming from Kimberly-Clark. Does that count as capital coming in?

Ric Reitz:

That would count as income unless you had losses to offset as a result of the production.

Scott Patterson:

Is there a private agreement that can occur between Kimberly-Clark and ECG so that ECG can apply to the state for the credits? Is there something the state will allow?

Ric Reitz:

No. The state wouldn’t allow that because they changed the statute in 2012 effective 2013, January 1, 2013.

Jason Sirotin:

One of the things that I hear a lot and they’re kind of rumors is that there are certain things that are not allowed to be tax credit. I hear that your legal feels cannot be a tax credit. Is that correct?

Ric Reitz:

Correct, legal fees associated with the sale of the tax credit. For instance, my broker fee wouldn’t count.

Jason Sirotin:

What about your legal on your film?

Ric Reitz:

There is production legal and then there’s legal for the acquisition of rights and licenses. Rights and licenses, no. Production legal, yes, which is structuring agreements between staff and individual, vendors or stars, whatever it had …

Jason Sirotin:

There’s an issue on a couple of films ago where they told us that we had to make the person a producer if they were our legal counsel in order for it to count for those forms. That’s misinformation.

Ric Reitz:

That came from the film?

Jason Sirotin:

That came from another attorney who we’re working with on the client side.

Ric Reitz:

I know several entertainment attorneys who do production legal for the big boys. Their cost are included in the development because A, he’s local. See, legal from out of state never counts.

Jason Sirotin:

Exactly because you’re shipping it out.

Ric Reitz:

That’s right.

Jason Sirotin:

Anyone who should be out. Now, how do they do when a big actor, Tom Cruise is in town? Do they have to pay him through a Georgia based company, right, like a Georgia LLC?

Scott Patterson:

How does that work?

Ric Reitz:

Basically, he’s going to have to set up a loan out corporation in the state of Georgia.

Jason Sirotin:

Tom Cruise will?

Ric Reitz:

Tom Cruise, it is. Anybody who is above the line or below the line that is not salary based but becomes loan out …

Jason Sirotin:

What does loan out mean?

Ric Reitz:

Loan out corporation means you can pay the corporation direct from the services of the person who owns the loan out. It’s not a salary. It’s a fee.

Jason Sirotin:

Got you.

Ric Reitz:

That’s critical because the state statute says the maximum salary you can pay an individual is $500,000 per project. For Tom Cruise, it’s 10 million bucks. It used to be 20 million but he’s 10 million now, whatever. It happens to be. He comes in and he files his little, his LLC or his little incorporation thing here, sole proprietorship for all I care. That becomes his loan out.

He has to register it. He has to pay taxes in the state of Georgia. In that loan out situation, anybody, goods and services or actor, anyone that uses a loan out has 6% immediately deducted from that figure.

Jason Sirotin:

If it’s 10 million, he’s losing 60,000.

Ric Reitz:

Correct. He loses that money. Actually, yeah. There you go. He loses that money to the state but when he files his taxes, because he doesn’t live here, he will probably get most of that back unless he’s incurred any other kind of revenue.

Jason Sirotin:

The production company wins out because they’re 10 million dollars actually cost them seven.

Ric Reitz:

There you go. That’s right. You get Tom. He does that. It’s a slight inconvenience to the star to do that.

Jason Sirotin:

Let’s put on to the star to do that.

Ric Reitz:

Right. Let’s put on anyone who has a manager and a financial partner. They end up, his team does it. The smaller people don’t. A lot of the local vendors got up and ballyhooed about, “Wait, wait, you took 6% out of this.” “We took it out as withholding because we’re required to. If you think you’re going to get the tax credit, that is the requirement. I have to withhold the 6% from you. Now, you use that on your taxes. At the end of the year, I’ll send you a form that said 6% of what’s due has been paid.”

Jason Sirotin:

Are tax credits going to continue in Georgia?

Ric Reitz:

Yes.

Jason Sirotin:

For how long you think?

Ric Reitz:

There is no sunset at them. We are a state without sunset. For as long as the legislature and the administration, the government and everybody else feels that it has a positive effect, it will continue. Now, this election for the governor’s office curtailed the day a little bit. We know the current governor is 100% behind the tax credit system. He said as long as he’s in office, nobody touches it.

If he wins, we’re good through 2020. Now, we’ve talked to Jason Carter and his team to be honestly fair and he is also in support of it. Oddly enough, his grandfather Jimmy Carter, former governor president, started the first film office in Georgia in the early ‘70s. Georgia was the first state outside of New York and California to have a film office. We are now 40 years in since 1974 in that first inauguration.

Jason Sirotin:

Ric, how do people get a hold of you?

Ric Reitz:

They can reach out to me online, Georgia Entertainment Credits. We’ve abbreviated it for the online signature as gaentcredits.com. There’s a hot link to me. Otherwise, you can write me direct at ric@gaentcredits.com.

Jason Sirotin:

Ric, thank you so much. Scott, with the Patterson Firm, thank you for joining us today. How can people get a hold of you if they need entertainment law?

Scott Patterson:

We’re at the pattersonfirm.com. You can reach me direct at scott@thepattersonfirm.com is my direct e-mail.

Jason Sirotin:

Thank you all for joining us on the Naked Unicorn podcast. I’m Jason Sirotin with ECG Productions. Make sure you check out our blog at ecgprod.com. We’ll see you next time. Thanks.

2 Responses

Great podcast, Jason. Ric is always full of rich and useful information.

One thing I wanted to point, out is that a lot of Producers assume the tax credits are applied to the overall budget. They are not. The tax credits are applied to “qualified expenses”. Personally, I prefer the phrase, “qualified expenses”, when talking with investors or potential investors. Here’s an example of the difference between total expenses and qualified expenses:

Let’s say you book 2 “A-list stars” for a project. You’ll need to arrange travel and accommodations (airfare/hotel). If you use Orbitz, Travelocity, Priceline, etc, to book the plane tickets and accommodations – those would NOT be “qualified expenses”. However, if you use a Georgia-based travel agent to book the exact same plane tickets and accommodations – those would be “qualified expenses”.

Let’s assume the airfare/hotel for the two stars cost the production a total of $25,000. Well, if it’s a non-qualified expense, the production isn’t able to claim the 30% tax credit; resulting in an approximate loss of $7,500 in lost tax credits (30% of $25,000).

It’s important for Producers to understand what is and what isn’t a qualified expense and to learn the nuances of the tax credits. Otherwise, they could be in for a big surprise when a portion of their expenses do not qualify for the tax credits.

Hope this helps someone. Keep up the good work.

R