When you think of the center of the movie-making world, what images come to mind? Do you envision sandy beaches, temperate climes, and So-Cal sensibilities? Do you conjure thoughts of big picture studio lots, droves of famous actors, and avocados with literally every fucking meal?

If so, I can’t blame you: since time immemorial, Los Angeles has been the definitive locale for video production. Tinsel Town, La La Land, Hollywood, the monikers are endless for the storied entertainment industry capital.

The truth, however, is that another town is coming for L.A.’s filmmaking crown. And it’s coming for it hard. There’s still plenty of big studios and big name actors here, but from there it’s a real Tale of Two Cities scenario. Think less sandy beach and more red clay; a little less So-Cal sensible and a little more Southern charm; a few less avocados and way more sweet tea.

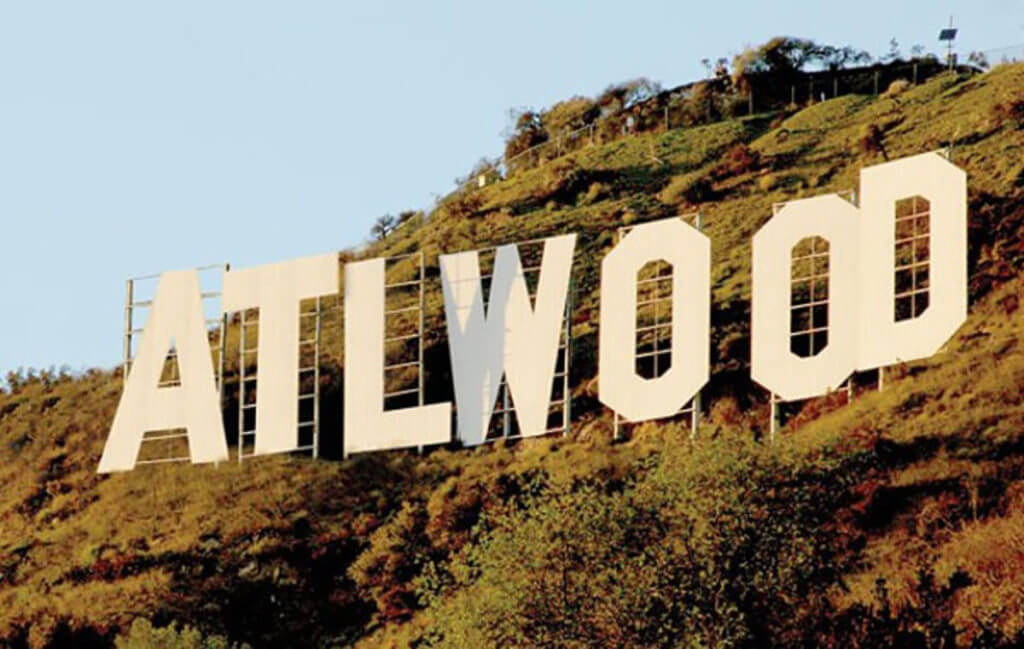

Yes, I’m talking about Atlanta. The Empire City of the South, A-Town, and as of late, ATLwood. With $6 BILLION dollars in revenue last year, Georgia is now the #1 place in the world for video production. And with the recently approved post-production tax break, it might just become the #1 town for video editing, too.

Investigating The Investment In Incentives

Atlanta’s meteoric rise to video production prominence didn’t just happen overnight. There’s plenty of beauty to the city, and Atlantans are some of the nicest people in the country. But it takes more than that to attract big film studio money. For that, you need government help. For that, you need tax breaks.

Unless you’ve been living under a rock, you’re probably familiar with the wildly successful video production tax break from way back in 2008. To say that piece of legislation was a success would be a gross understatement. All it did was boost the state’s economic growth, create hundreds of jobs, and set the state capital up as an industry hub and artisan destination. No big deal.

The only problem with 2008’s landmark tax break: it didn’t go far enough. As it states in the bill, Georgia offers between a 20-30% tax break for films shot & produced in the state. Nowhere on the document does it say anything about where the film goes through post-production.

If you know anything about films, you know that as expensive as shooting a film can be, post-production is almost always even more of a pain in the wallet. Letting these films shot on location in Georgia go through post-production in other states means letting dollars leave the state. No way that would ever stand for long.

Breaking Down the Tax Break

As of March 22nd 2017, Georgia passed its 2nd major tax break incentive for video productions. This new legislation offers a 20% tax incentive to post-production companies with at least $250,000 on their payroll in Georgia. These companies must also spend $500,000 per tax year.

However, if the project that the post-production company is working on was produced solely in Georgia, the company is also eligible to receive up to 30% of what they spend back in tax credits that can be sold on the open market.

Phew, that was a mouthful. Thanks for bearing with me while I word-vomited all that tax-speak. Now, what does this really mean? As in, how will this affect Georgia-based post-production houses in the future?

The short answer: they should make a lot—and I mean a LOT—more money. In the same way that 2008’s bill drew productions to Atlanta like Hipsters to a case of Miller High Life, this new legislation promises to keep video editing in ATLwood. That means millions of dollars and hundreds of jobs for both the Atlanta area and Georgia as a whole.

After getting up to a 30% tax break on the production just for shooting in Georgia, why not get another potential 30% break for staying put for post-production? Directors & producers love returning home for the long haul of post-production. But the studio bigwigs have the ultimate say-so on where that happens, and studio execs LOVE saving money. By this logic, Atlanta is now a highly desirable post-production center.

Where We’ll Be Fixing It In Post

Over the next few years, the post-production scene in Atlanta is set to explode. With established major video editing companies and boutique post-production houses abounding, ATLwood is primed for the oncoming flood of work.

ECG Productions is just one of the many, many Atlanta-based production companies that thrive on post-production work. It’s an exciting time for both us and our industry as a whole, and we’re excited to watch the video production scene continue to flourish in our great city.

But what do YOU the reader think? I’m sure that most of you reading this are involved in video production or video editing in some way. What are your thoughts on the GA post-production tax break?

Do you think that it will be as alluring as the big tax break that started the rise of ATLwood? Have you, personally, seen any of the trickle down effects of this new legislation yet? Do you think I’m just talking out of my ass?

I’m open to any and all discussion in the comments! I’d love to chat more about this exciting new development for Atlanta!

12 Responses

Great read! I don’t think you’re talking out of your as at all, but I would love some clarification on how the selling of these credits on the open market works.

Say I have $100k in tax credits to sell on the open market, who buys them and are they guaranteed to sell or is it up to me to find a buyer? Say they sell, do I get to keep the $100 and use it for whatever I want or do I have to do something special with it?

This article would be 10/10 for me if it answered these questions, but right now I have to give it 9/10 for leaving me hanging on the finer points.

Great question Brandaniel! There are two ways this can play out.

1. If you have $100,000 in Georgia tax credits and you have a large tax liability you can use these credits dollar for dollar and as needed. So let’s say you have $20,000 of tax liability in 2018. In this situation, you can pull from your $100,000 worth of tax credits to cover that liability. Now you have $80,000 in Georgia film and video tax credits remaining in your tax credit stockpile. Pretty sweet deal.

2. The second scenario is more complicated. Let’s say you don’t have a large tax liability and therefore having a tax credit is worthless to you, that’s when you can opt to sell your tax credits for cold hard cash! The only problem is you can’t sell them dollar for dollar because there is no benefit to the person buying them. In this situation, buyers will pay anywhere from $0.65 to $0.92 on the dollar. So if you only could negotiate $0.65 on the dollar you would get a payout of $65,000 for $100,000 worth of tax credits. Both business and individuals can buy these tax credits and the amount paid for purchase is very dependent on timing. Selling tax credits in February, for example, is a great time to sell because corporations and high net-worth individuals are starting to work on their taxes and their looking for any way to save money.

I hope this clarification gets this article to a 10. I give your question a 9.5. 🙂

Great write up! Thanks for breaking this down so it’s easily digestible. Hopefully this will be another big job creator for the film sector.

I’m trying to understand the basics of the Tax Credit. Does this mean that if I make a movie and it costs me $1million to make, I can potentially have a tax credit of $300,000? So, in essence that $1million movie only costs me $700,000 to make?

Hey Pierce,

That’s a great question! To keep it short and sweet: yes, that is exactly what the incentive means.

It’s a crazy cool incentive, which is why so many productions have been flooding to GA over the last half-decade or so.

That picture at the top is so fake. There is no ATLwood sign. You are a liar.

Hey Billy Jean,

Thanks for the comment! And you’re right, there is no ATLwood sign. I apologize for the confusion!

This is more meant to be a visual metaphor for Atlanta’s meteoric rise to prominence in the entertainment industry, nothing more.

Also, as I’ve learned, ATLwood isn’t even the biggest nickname for Atlanta’s burgeoning film scene. That distinction belongs to “Y’allywood.” Cute, eh?

Great write up! Thanks for breaking this down so it’s easily digestible. Hopefully this will be another big job creator for the film sector.

In the movies what comes first filming or post production? because I thought that it was post pro but I wanted to because of mockingjay the new hunger games movie and it says part one is in post pro and part 2 is filming right now. How long does post pro take in order for them to get it out in movies

hey great write article its very helpful thanks for sharing.

thank you

Doggy Be Good CBD Oil

Companies who make feature films, TV series, music videos, and commercials, as well as interactive games and animation, can save up to 30% on their expenditures by taking advantage of the film, television, and digital entertainment tax credit. A 20 percent tax credit is available under Georgia’s entertainment industry investment law.